You might qualify for help from an organization referred to as a tax clinic. You may hire an attorney or other person admitted to practice before the Tax Court to represent you before the Tax Court. What if I move or change my address after I file a petition?.What happens if I can’t find my copy of a document filed with the Tax Court?.What should I do if I receive a “no change” letter from the IRS after I file a petition in the Tax Court?.I received a letter from the IRS seeking to assess or collect the tax for the same tax year(s) I petitioned. I filed a timely petition with the Tax Court in a deficiency case.

Will the Court correct the title of a motion (or other document) that is titled incorrectly? I would like to file a motion but I’m not sure what to title it.What is a motion for summary judgment? How should I respond to one?.What are some of the common motions that can be filed?.Someone told me that if I want to ask the Tax Court to take some action affecting the other party, I should file a motion.How can I check on the status of my case?.After I file my petition, how many copies of any documents should I send the Tax Court if I decide I want to file anything else?.What can I do if I forgot to say everything I wanted to in my petition?.How can I be sure that I have done everything correctly?.May I request that my case be heard remotely?.

#Petition filed documents trial#

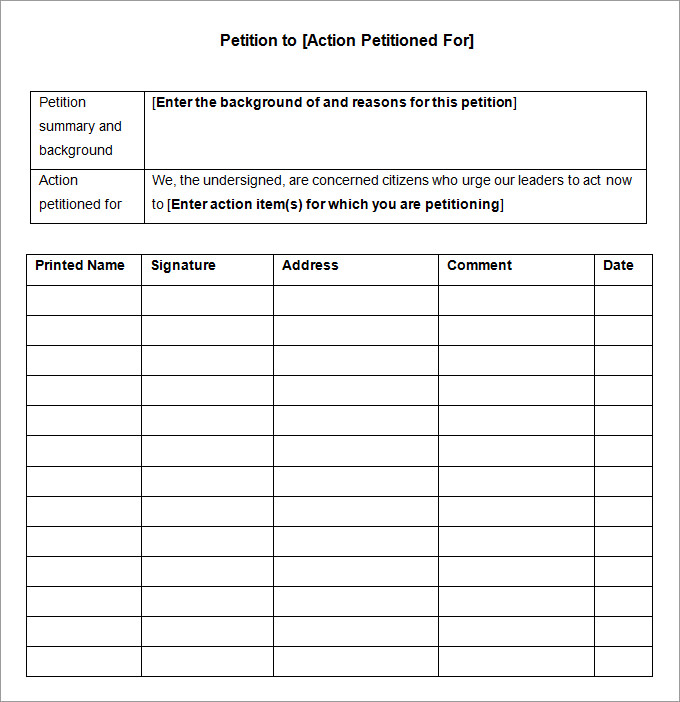

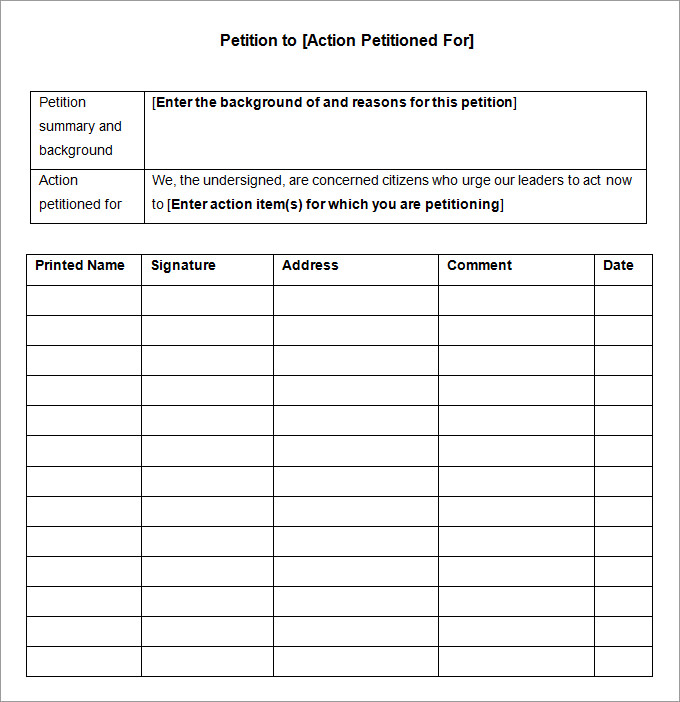

May I request trial in a more conveniently located city outside my state?. Where may I request a place of trial if I elected to conduct my case as a regular tax case?. Where may I request a place of trial if I elected to conduct my case as a small tax case?. Should I send anything else to the Tax Court when I file my petition?. Should I include anything else with my petition?. Must I pay the amount of tax that the IRS says I owe while my case is pending in the Tax Court?. Are there any circumstances where I do not have to pay the $60 filing fee?. Does it cost anything to file a petition?. Is it too late to file a petition with the Tax Court? How do I ensure that the petition is filed on time?. May I file my petition electronically or by fax?. What if I forget to redact or delete personal information?. How do I delete or redact my Social Security number or other private numbers from documents?. How can I protect the privacy of personal information such as my financial account numbers?. How can I protect the privacy of my Social Security number?. How do I decide whether to elect regular or small tax case procedures?. If I decide to file a petition, what is the next step?. Should I file a petition even though I thought my case was settled? I thought I came to an agreement with the IRS, but the IRS sent me a notice of deficiency or a notice of determination stating that I have a right to file a petition with the Tax Court. If I need an interpreter at trial what should I do?. Are there any circumstances where the Court will help pay for the cost of an interpreter at trial?. What should I do if I don’t speak and/or understand English very well?. If I want to represent myself or if I don’t qualify for representation by a tax clinic, can I represent myself?.

Is there anyone who can help me file a petition and/or help me in my case against the IRS?.Who can file a petition with the Tax Court?.How do I start a case in the Tax Court?.

0 kommentar(er)

0 kommentar(er)